Still, they’re both brands of credit scores and they consider similar factors when calculating scores, says Sara Rathner, credit cards expert at Nerdwallet.

#CREDIT SCORE RANGE SCALE FREE#

VantageScore 3.0 is a compeyting credit scoring model developed by the three bureaus that’s primarily used for pre-screened marketing offers and free credit scoring websites.

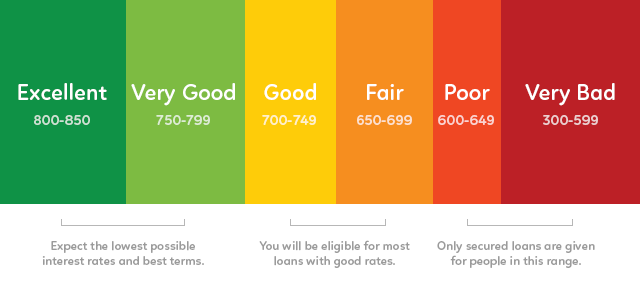

You can find out your FICO score at here. FICO scores rely on data tracked by the three major credit bureaus Experian, Equifax and TransUnion. Though you have credit scores from multiple consumer credit bureaus, it is your FICO credit score that is most used in lending decisions, says Ted Rossman, senior industry analyst at Bankrate. FICO: What are they and why are these different? Higher scores usually result in more favorable credit terms and lower scores make it more difficult to qualify for competitive rates. These three-digit numbers, which typically range between 300 and 850, highlight your credit risk. How can you check and monitor your credit?Ĭredit scores are really just a number used by lenders that predict how likely a consumer is to pay back a loan on time.

What do credit score ranges mean for you?

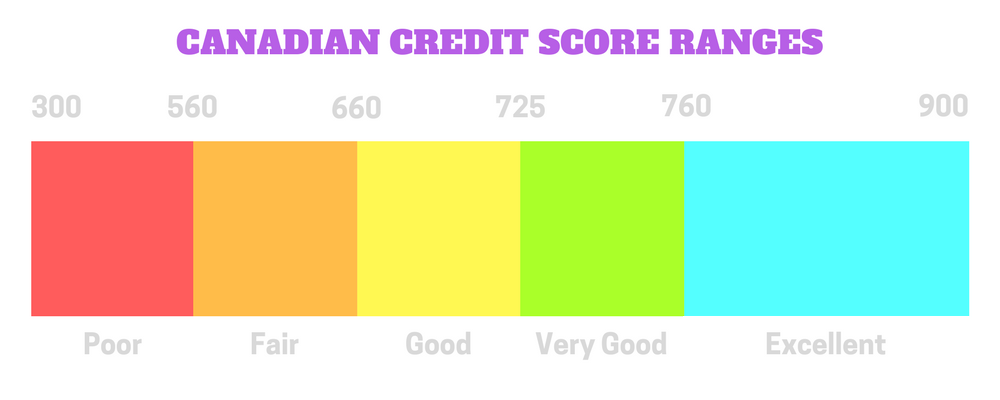

How does your credit score differ among the different types of scores? The differences between a VantageScore and FICO score Step one is knowing what they look like: Credit scores typically range from 300-850, and below is how they shake out. (Looking to find out your credit score? You can get your FICO score, which is the credit score most used in lending decisions, at, and sites like CreditKarma and AnnualCreditReport give you credit reports for free.) FICO® credit score ranges

0 kommentar(er)

0 kommentar(er)